If you don’t have a sound budgeting plan, business expenses can mount up very quickly.

Running a business without a carefully considered budget could put you in financial trouble.

35% of companies overspent their budgets in 2020. These companies might have gone out of business without solid backup and additional funds.

What’s even sadder is that 46% of companies didn’t even create a budget for 2021.

That’s where certain smart budgeting hacks come into the picture.

Why budgeting is important?

What makes budgeting crucial? Beginning with proper budgeting, you can create financial stability for your company. Since you’re better managing and keeping track of your expenses, it enables you to be in a proactive financial position by eliminating income ambiguity.

In addition, the following are some additional justifications for learning sound budgeting techniques:

- Clarity in decision-making.

Having accurate budget data on which to base your supply purchases makes decision-making much simpler.

- Make a growth or goal plan.

Budgeting allows you to see how much money you’ll need to save to achieve any goals you have for the next five years.

- Ensure a healthy cash flow.

To keep your business afloat, you need cash flow to pay for necessary daily costs for operations as well as other significant issues.

- Recognize your areas of spending excess.

By not overspending on non-investment-worthy items, you can improve the bottom line of your company’s finances.

- Obtain financing or credit for your company.

You need a sizable amount of funding if you want to grow your company. And any bank or lender will inquire about the financial health of a company.

- Make plans for unanticipated costs.

Sales were halted when stores were forced to close due to the pandemic. As the weeks passed, some stores closed their doors, which resulted in sizable employee layoffs.

How to make your budget for business better

Budgeting issues frequently force IT departments to make cuts. However, because of the COVID-19 pandemic and the widespread cybercrime, businesses are looking to increase their IT spending this year. The fastest rate in more than a decade, according to Gartner’s 2022 CIO and Technology Executive Survey, CIOs anticipate an increase in IT budgets of 3.6% this year.

Here are a few spending guidelines that companies can use to maximize their investment:

Utilize real-time data because trends and conditions are constantly changing in our quick-paced world. You must include the most recent data in your budget if you want to stay current. When you have access to the most recent expense and reimbursement reports, there’s a good chance you could stop some expenses in their tracks and even produce more precise financial projections.

Make both macro and micro budgets. Macro budgets offer a more comprehensive view of an industry, nation, or economy. Micro budgets, on the other hand, can be weekly or monthly budgets that help you keep tabs on your spending, which could otherwise get out of hand if neglected for too long.

An organized budget is one that is successfully carried out. All budget discussions should be recorded and made available to all departments so that there is transparency at work and business heads are aware of their exact responsibilities and resource allocation.

Maintain flexibility: You have the flexibility to respond quickly to changes in the business environment thanks to live data and microbudgets. Small businesses require this crucial skill, especially in today’s world where business environments are changing quickly.

Align budget with strategy: You must do this after you reach break-even point or begin making a healthy profit margin. If you need to build a new office, enter a new market, hire new IT professionals, or make an acquisition, only when your budget and strategy are in sync will you be able to accomplish your goal.

Having backup budgets: Alternative budgets are those created to account for any significant changes you anticipate having an impact on the business. It might result in something advantageous, like receiving a round of funding, or something detrimental, like failing to generate income during a particularly lean time.

Analyze your cash flow: If your cash flow is strong, you won’t ever experience the annoying liquidity problems that can make even the most profitable companies fail.

Select the appropriate budgeting techniques: Just as there is no one-size-fits-all business model, there is no one budgeting technique that works for all businesses. You must select a budgeting technique based on the size, nature, and goals of your business. You might select:

- Budgeting based on activities rather than a specific objective.

- Value-based budgeting, which allocates funds to departments in accordance with the value they produce.

- Zero-based budgeting requires justification of each department’s spending plan before funding is allocated.

7 steps to creating a smart budget for your small business

In 66% of cases, small businesses face financial difficulties, with 43% citing operating expenses as their biggest issue. Small companies are the ones with the lowest budget prevalence. This is due to their dislike of creating one. However, small businesses must develop a budget because it enables them to produce consistent growth and advance their operations.

Unlike large corporations, which must show sound financial management to manage their sizable budgets, small businesses must be resourceful to make the most of their funding since it is difficult to obtain. When creating your budget, small businesses should take into account these seven factors.

- Look at your income: Finding out how much money you have or make each month and annually is the first step. In other words, to calculate gross sales, add up all of the revenue from each vertical. Your financial statements will begin with this number.

- Determine your variable costs, which change from month to month. Utility bills, shipping and travel costs, and commissions are a few examples. Your profit is impacted by each of these costs. You can improve your bottom line and expand your business by lowering your variable costs.

- Determine your fixed costs: The next step is to determine your fixed costs. These expenses, such as payroll, rent, and website hosting, are consistent from month to month.

- Put everything together: It’s time to total everything up and subtract expenses from income. You will be able to make wise financial decisions after seeing your profits on this. A negative balance indicates that you need to boost sales or cut costs. You can grow your company by taking calculated risks if your business is profitable.

- A one-time cost is a non-operating expense subtracted from a company’s income for a one-time or exceptional event that is not likely to happen again. It might be the price of renting office space, moving, or even setting aside money to pay a security consultant in the event of a cyber incident.

- Forecasting your revenue and profit is another step in creating a budget. The forecast can help you decide what direction your company should go in. In comparison to companies that simply take things as they come, you are automatically better prepared to handle risks and pitfalls if you analyze potential future outcomes to estimate the forecast.

- Renegotiate your contracts with vendors: If you and your vendors have an annual agreement, you can do so to obtain better terms each year. Small price reductions with numerous vendors can significantly impact your profits and help your company expand.

4 smart budgeting hacks:

1. First, chart out a business plan

Your budget’s foundation is your business plan.

A business plan should typically span a longer time period and include your long-term objectives, marketing, and strategy.

You should begin developing a plan by identifying small, doable organizational goals that will help you achieve the bigger objectives you’re aiming for.

Despite being important, budgeting only makes up a small portion of the annual business plan. After all, in order to accomplish those smaller objectives, you must manage your finances and make spending decisions.

You’ll stay on course with that kind of business plan.

Check it frequently to see if you’re deviating from your original plan. If so, you run the risk of going over budget and experiencing financial difficulties.

In addition to serving as a roadmap for your goals, a strong business strategy will also help you achieve them.

Use the plan to see how new ideas fit into your overall yearly plan when you are trying to fit them into your budget.

Before moving on to the goals and objectives, provide some background on the origins of your company.

After defining and listing the particulars of your plan, add some details:

- Your goods or offerings

- A price list

- Results of market research

- Sales and marketing initiatives

- Daily activities

- The budget

- And then the summary

It will take time to go into the specifics of all these issues, but it will be a great starting point for future decisions, especially financial ones.

2. Select the Appropriate Budgeting Approach

There is no one-size-fits-all approach to budgeting, but there is a technique that will work for your business. You just have to look for it.

The method for managing expenses According to Divvy, businesses typically employ one of the five budgeting techniques listed below:

- incremental

- zero-based

- value-based

- adaptable

Utilizing the incremental method, you can add to or subtract from the budget from the previous year based on how well your predictions held true.

You could subtract some money from the budget for the new year if you overestimated your expenses the previous year.

Similarly, if you think you underestimated them, you can increase the budget by whatever amount you think is appropriate.

Similarly, if you think you underestimated them, you can increase the budget by whatever amount you think is appropriate.

Use last year’s spending as a starting point for this year’s budget to better understand it, then assess how accurate it was.

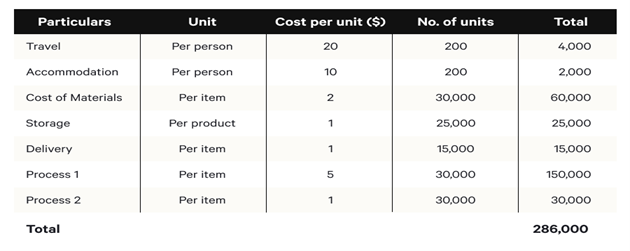

The activity-based method entails determining the business activities for the following year, their units, and the costs associated with each unit.

Utilize the following formula:

Cost of overhead for each activity X Activity count = allocated funds

If you estimate that you will sell 1,000 items at a cost of $2 each, you will budget $2,000 for unit production. You can better understand your spending habits using this method.

With the zero-based strategy, each department’s starting budget is zero dollars. The departments then forecast their budgets and provide justifications.

3. Listing probable risks of the budget

Your financial statement for the coming year is your business budget.

You should create a budget at the end of each year, dividing the available funds among various business expenses and commitments.

You shouldn’t ignore possible budgeting risks, though.

According to the definition of such risks, they are “the potential for some items to deviate from the originally predicted cost,” so you should closely monitor every aspect of your budget and identify any items that might end up costing you more.

You can plan and budget more effectively if you understand risks, so doing so is absolutely necessary.

The best places to start when evaluating risk are changes to the minimum wage, healthcare requirements, or natural disasters.

You should plan because all of these changes could have a significant impact on your spending and business operations.

Surprisingly, one of these things is rapid growth, despite how contradictory that statement may seem.

Assume you want to sell 1,000 items each month and have the supplies necessary to fill those orders.

However, you’ll need to make changes if your company unexpectedly grows and you need to fill orders for 2,000 items.

Some of them, like ordering more supplies, might be expensive.

Similar to paying more for express shipping, you will pay more if you place an order at the last minute.

As a result, you might spend more than you would for steady, organic growth because of the sudden doubling of orders.

Keep track of all potential financial risks to avoid bankruptcy by not letting risks catch you off guard.

4. Establish realistic financial goals

The best way to make a budget is to start with realistic financial expectations.

Make decisions based on reliable data if you don’t want to frequently go over budget.

Be practical rather than hoping for the best when creating your budget for this year. How much cash will you have available to invest in your company this year?

As soon as you have a general idea of that sum, use your budgeting strategy to determine how much you’ll spend on each activity or section.

If you’ve been in business for some time, you can use the expense statements from last year to make a budget for the upcoming year while taking into account the precise amounts spent on each section of your business plan.

Along with the projected and actual budget from the prior year, take into account your anticipated income.

Don’t expect every month to be as successful as the best month from the previous year. In order to avoid overestimating your resources, aim for the median.

Think about any adjustments you might make to your business.

This factor could be anything you already know will affect your bottom line, like adding more workers, increasing production, inflation, etc.

If you take into account these potential changes in your budget, you won’t be caught off guard.

Use actual data to estimate how much you can spend while remaining realistic when creating your budget.

To conclude

Even if you are just starting a business and have no idea where to start, budgeting does not have to be challenging.

Your long-term business plan needs to include a list of your yearly goals. Then, make a budget that will assist you in achieving those objectives.

Increase your budget for the projects that will enable you to carry out your business plans.

As a result, pick the budgeting strategy that works best for your business and be conservative with your projections.