Silicon Valley Bank (SVB), founded in 1983, specialized in lending money to technology and biopharma start-up companies. It funded the start-up companies by borrowing deposits from rich companies. To maintain the interests of these wealthy depositors, SVB generated the funds by choosing to invest their money in a secure long-term Treasury Bond.

Before moving ahead, a basic idea about Treasury Bonds is necessary to understand what happened with the Silicon Valley Bank (SVB).

If you are already accustomed to the term, skip to Why Did the Collapse Happen?

A treasury bond is a debt security issued by the United States Department of the Treasury to finance the government’s operations and activities. Treasury bonds are considered the safest investments available and are highly liquid, making them a desirable option for investors seeking capital preservation and a steady income stream.

Now, answering the question in everybody’s mind.

Why did the Collapse Happen?

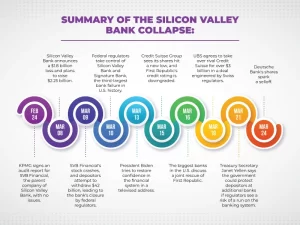

All was well until the Federal Bank decided to increase the interest rate, forcing SVB to provide better interest rates to its depositors. The only hurdle was that the money was locked into long-term, low-interest Treasury Bonds. This, in turn, urged the depositors to withdraw their money in search of higher interest rates, forcing SVB to sell some of its Treasury bonds at a loss (bonds fall in value when interest rates increase).

As a result, the bank started to face a liquidity crisis which occurs when a bank does not have enough money to make up for the amount withdrawn by the depositors. SVB soon realized it needed to raise money. Hence, it filed with the Securities Exchange Commission (SEC) to raise funds. This got them noticed by depositors, sending a message that the bank was insolvent and making them rush to withdraw their money.

During the weekend, the FDIC assumed control of the bank and assured all depositors that they would receive their money back, even if their deposits exceeded the $250,000 FDIC deposit guarantee. This action was taken to prevent panic among customers.

Notably, the bank’s collapse was not due to high-risk investments or fraudulent activities but rather because it had not predicted the impact of investing depositors’ money into low-yielding securities.

What are the impacts of the Silicon Valley Bank Collapse Breakdown?

As a bank that provided financing for almost half of U.S. venture-backed companies, the impact of the Silicon Valley Bank Collapse had enormous implications, some of which are listed below:

- Many of the world’s leading companies relied on SVB for their financial services. In such a short period, they are finding it difficult to find a replacement that can match the services like lending, cash management, and investment banking.

- Another global impact of the collapse is on the United State’s leadership position in technology and finance. SVB’s failure has many geopolitical implications. As among the top 20 American commercial banks, SVB had relationships with many banks and financial institutions worldwide. And this collapse made it easy for people to question the continuity of the United States on remaining on top in these sectors.

- The collapse of SVB has had a ripple effect beyond the United States, affecting numerous countries worldwide. Many of the world’s top tech firms are based outside the U.S., so they rely on SVB’s essential financial services. These firms now face greater difficulty obtaining financing and accessing necessary financial assistance.

Role of the FDIC

Federal Deposit Insurance Corporation (FDIC) is a U.S. government bureau that was founded in 1933 in response to the widespread bank failures of the Great Depression. Its primary purpose is to insure deposits in banks and savings associations, promoting stability and public confidence in the financial system. The FDIC can insure deposits up to $250,000 per depositor per bank and supervises and examines banks to ensure their safety and soundness. In addition, the FDIC plays a role in resolving failed banks and minimizing losses to depositors and the deposit insurance fund. The FDIC sources funds from premiums paid by member banks and thrift institutions. It plays a critical role in safeguarding the U.S. financial system and promoting stability in the banking industry.

Would tech industries be vulnerable post the Silicon Valley Bank Collapse?

While the government’s announcement should give most companies assurance that they’ll eventually get their money back, there may be some difficulties to overcome in the short term. Tech companies that had money with SVB and could not access it face a big problem: payroll. The FDIC guarantees some deposits, but more is needed to cover all the money that companies had with SVB. This concerns companies that deposited cash with SVB and those that used other SVB financial products, like loans or credit cards. And, even if the companies directly didn’t use SVB may be affected because, for many of them, their vendors were connected with the bank.

The Bottom Line

The second largest bank failure is a setback for businesses and countries worldwide as they have to deal with the losses and the implications of the Silicon Valley bank collapse and be even more cautious of what lies ahead. While FDIC ensures people they’ll get their money back, it is still a lot of mess to clean up. And there is even the question of whether it can help the depositors with more than $250k. The collapse of SVB highlights several risks due to its focus on the technology sector, regulatory factors, competition, and external events. Businesses and governments worldwide must closely watch the situation and plan how to deal with its aftermath.