Virtual currency platforms have transformed the way we trade, invest, and manage digital assets. With the surge in popularity of cryptocurrencies, choosing the right platform can significantly impact your trading experience. This comprehensive guide will help you navigate through the top virtual currency platforms, understand their features, and make informed decisions.

What Are Virtual Currency Platforms?

Virtual currency platforms are online services that allow users to buy, sell, trade, and manage cryptocurrencies. These platforms operate similarly to traditional stock exchanges but are tailored for digital assets. Key factors such as security, fees, available cryptocurrencies, and user experience are crucial when selecting a platform.

Benefits of Virtual Currency Platforms

- Accessibility: Trade cryptocurrencies from anywhere with internet access.

- Diverse Options: Access a wide range of digital currencies beyond just Bitcoin.

- Advanced Features: Benefit from tools like staking, lending, and margin trading.

- Security: Platforms with robust security measures protect your digital assets.

Top Virtual Currency Platforms in 2024

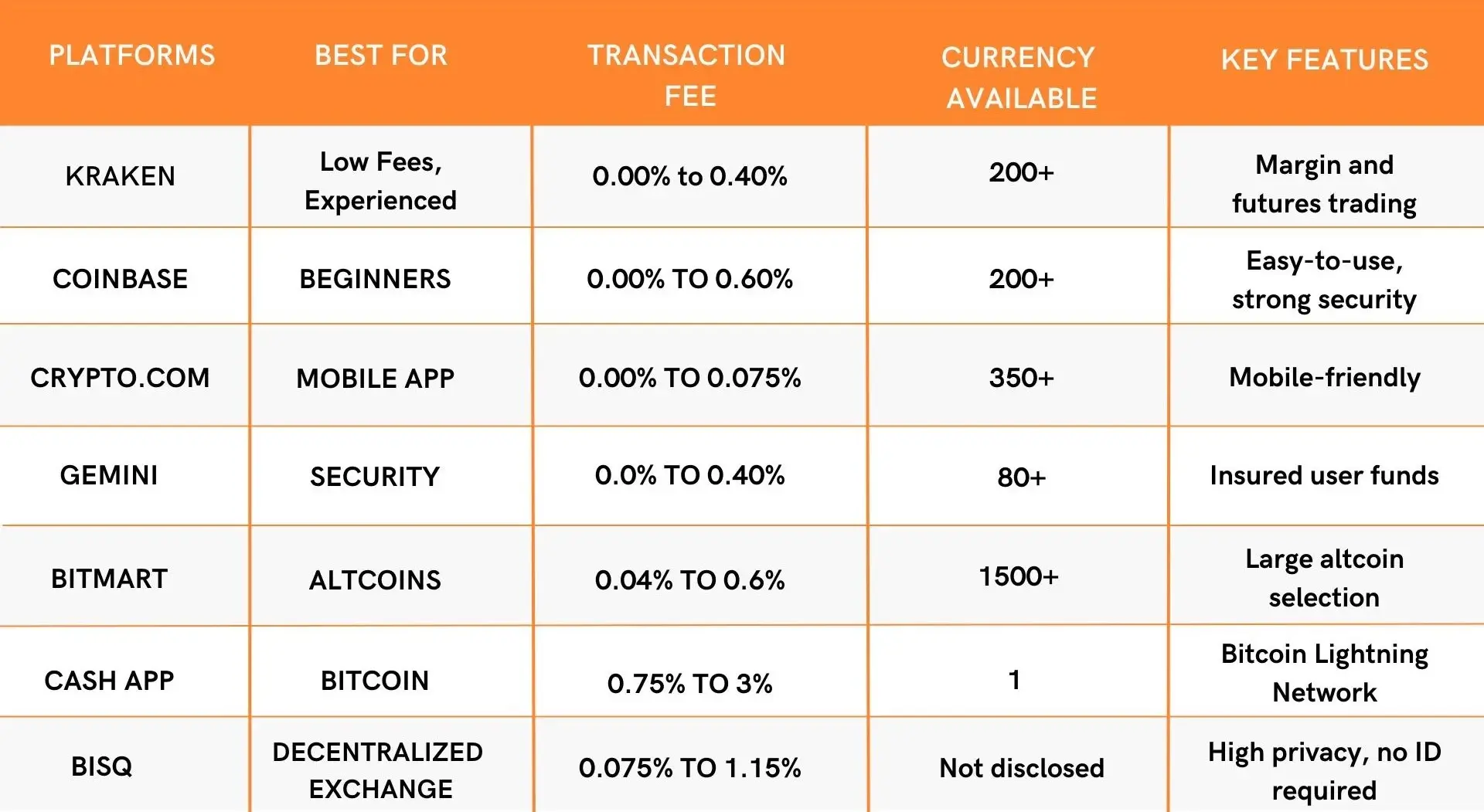

1. Kraken

- Best for Low Fees and Experienced Traders

- Transaction Fees: 0.00% to 0.40%

- Currencies Available: 200+

- Key Features: Advanced trading options, margin, and futures trading.

- Pros: Low fees, high liquidity.

- Cons: Limited account funding options.

2. Coinbase

- Best for Beginners

- Transaction Fees: 0.00% to 0.60%

- Currencies Available: 200+

- Key Features: Easy-to-use interface, strong security.

- Pros: Beginner-friendly, advanced trading options.

- Cons: High fees on some transactions, custodial wallet.

3. Crypto.com

- Best Mobile App

- Transaction Fees: 0.00% to 0.075%

- Currencies Available: 350+

- Key Features: Extensive trading ecosystem, mobile-friendly.

- Pros: Supports a wide range of cryptocurrencies, mobile app.

- Cons: Poor customer support.

4. Gemini

- Best for Security

- Transaction Fees: 0.0% to 0.40%

- Currencies Available: 80+

- Key Features: SOC 2-certified, insured user funds.

- Pros: Robust security, highly liquid.

- Cons: High fees on many trades.

5. BitMart

- Best for Altcoins

- Transaction Fees: 0.04% to 0.6%

- Currencies Available: 1500+

- Key Features: Large selection of altcoins, simple buy/sell feature.

- Pros: Supports numerous cryptocurrencies, earning opportunities.

- Cons: Experienced a major hack in 2021, mixed customer feedback.

6. Cash App

- Best for Bitcoin

- Transaction Fees: 0.75% to 3%

- Currencies Available: 1 (Bitcoin)

- Key Features: Easy-to-use, supports Bitcoin Lightning Network.

- Pros: Seamless Bitcoin transactions, user-friendly.

- Cons: Only supports Bitcoin, custodial wallet.

7. Bisq

- Best Decentralized Exchange

- Transaction Fees: 0.075% to 1.15%

- Currencies Available: Not disclosed

- Key Features: High privacy, no ID verification.

- Pros: Global availability, 50+ payment options.

- Cons: Slow transaction speed, low trading volumes.

How to Choose the Best Virtual Currency Platform

Choosing the right virtual currency platform depends on several factors:

Security: Look for platforms with strong security protocols like two-factor authentication (2FA), cold storage for funds, and insurance against breaches.

Fees: Consider the fee structure, including trading, withdrawal, and deposit fees. Lower fees can save you money in the long run.

Supported Cryptocurrencies: Ensure the platform supports the cryptocurrencies you want to trade. Some platforms offer a limited selection, while others provide access to hundreds of digital assets.

User Experience: The platform should be easy to use, especially for beginners. Look for intuitive interfaces and comprehensive customer support.

Payment Methods: Check the available payment methods. Most platforms support bank transfers and credit/debit cards, while some also accept PayPal and other digital payment methods.

This guide incorporates valuable information from multiple sources to provide a comprehensive overview of virtual currency platforms. By following this guide, you’ll be well-equipped to navigate the dynamic world of digital asset trading.

Real-World Applications of Virtual Currency Platforms

Virtual currency platforms are not just for trading. They offer various features that can enhance your digital asset management:

Staking and Lending: Earn passive income by staking your cryptocurrencies or lending them to other users.

Margin Trading: Leverage your positions with margin trading to maximize potential returns.

Crypto Savings Accounts: Store your cryptocurrencies in savings accounts to earn interest.

NFTs and DeFi: Explore the world of non-fungible tokens (NFTs) and decentralized finance (DeFi) through these platforms.

Conclusion

Virtual currency platforms are revolutionizing the way we interact with digital assets. By choosing the right platform, you can enhance your trading experience, secure your assets, and explore new financial opportunities. Whether you’re a beginner or an experienced trader, there’s a platform out there that fits your needs.